Capital account is a critical record within a nation's balance of payments that tracks the flow of assets between countries. It is one of the two primary components of the balance of payments, alongside the current account. While the current account measures a country's net income from trade in goods, services, and transfers, the capital account records the net change in the ownership of national assets. This comprehensive guide from G2B will explain everything you need to know about the capital account.

This article outlines the key aspects of the Capital Account to help businesses gain a clearer understanding of its components and how it differs from other financial accounts. We specialize in company formation and do not provide financial advice. For strategies or compliance-related matters concerning capital transactions or cross-border investments, please consult a qualified legal or financial expert.

What is Capital Account?

The capital account is a systematic record of all international transactions of assets between the residents of one country and the rest of the world. It typically includes capital transfers such as debt forgiveness, transfer of ownership of fixed assets, and transfers of intangible assets like patents and copyrights. These assets can be of various forms in which wealth is held, such as stocks, bonds, real estate, and government debt.

When a domestic resident purchases a foreign asset (like an Indian citizen buying property in the UK), it is recorded as a debit on the capital account because capital is flowing out of the country. Conversely, when a foreign resident purchases a domestic asset (like a Japanese investor buying shares in an Indian company), it is recorded as a credit, signifying a capital inflow.

In essence, the capital account reflects the net change in a nation's foreign assets and liabilities. It shows whether a country is a net importer of capital (more foreign investment coming in than domestic investment going out) or a net exporter of capital (more domestic investment going abroad than foreign investment coming in). A surplus on the capital account indicates that a country is a net importer of capital, with inflows exceeding outflows. Conversely, a deficit suggests the nation is a net exporter of capital, increasing its ownership of foreign assets.

It is important to note a distinction in terminology. While most of the world uses the term "capital account" to cover all these investment flows, organizations like the International Monetary Fund (IMF) use a narrower definition. The IMF splits these flows into two main categories: The financial account and the capital account. In the IMF's framework, the financial account records most of the investment flows like FDI and FPI, while the capital account is reserved for a smaller subset of transactions.

In Vietnam, the term "Capital and Financial Account" often combines both accounts to reflect the total capital flows, including foreign direct investment (FDI), portfolio investment (FPI), official development assistance (ODA), commercial loans, and other short-term and long-term capital movements. With FDI remaining a key driver of growth, many foreign investors choose to register a company in Vietnam, partnering with reputable local service providers to ensure compliance and smooth market entry.

Relationship between Capital Account and Current Account

The capital account and the current account are the two main pillars of a country's balance of payments (BoP). They are intrinsically linked, and understanding their inverse relationship is crucial for grasping a country's overall economic health and its interactions with the global economy.

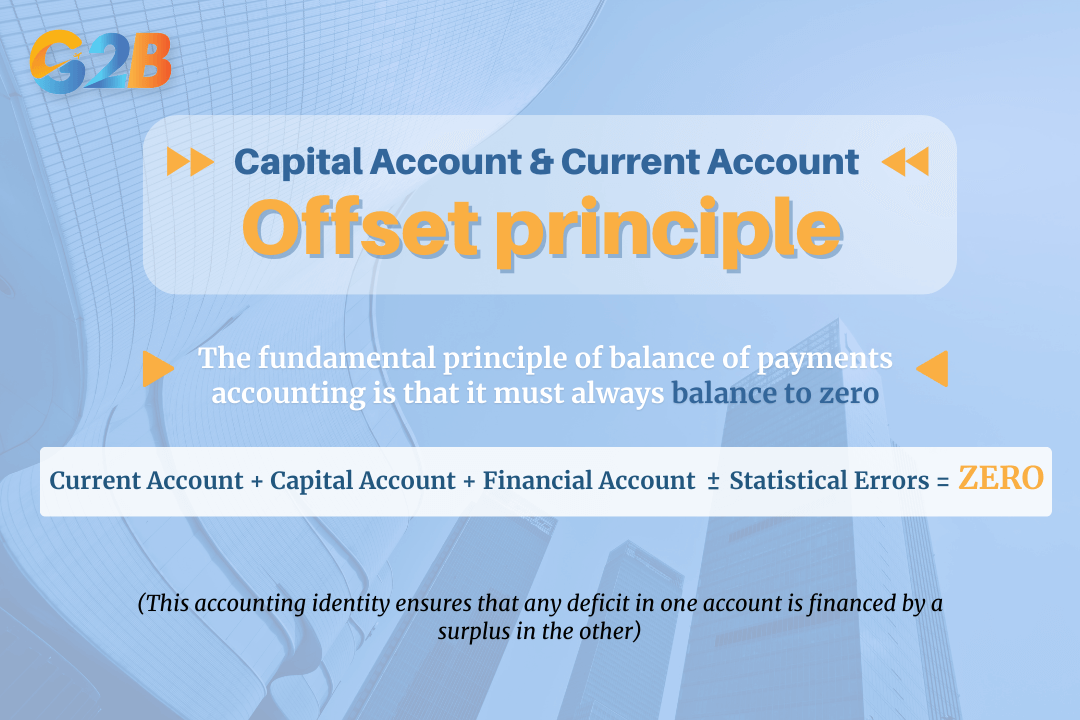

Offset principle

The fundamental principle of balance of payments accounting is that it must, by definition, always balance to zero. This means that the sum of the current account, the capital account, and the financial account (plus or minus any statistical errors) must equal zero. This is based on a double-entry bookkeeping system where every transaction has two sides - a credit and a debit. For example, when a country exports goods (a credit on the current account), it receives payment in the form of a foreign asset (a debit on the financial account). This accounting identity ensures that any deficit in one account is financed by a surplus in the other.

The fundamental principle of balance of payments accounting must always balance to zero

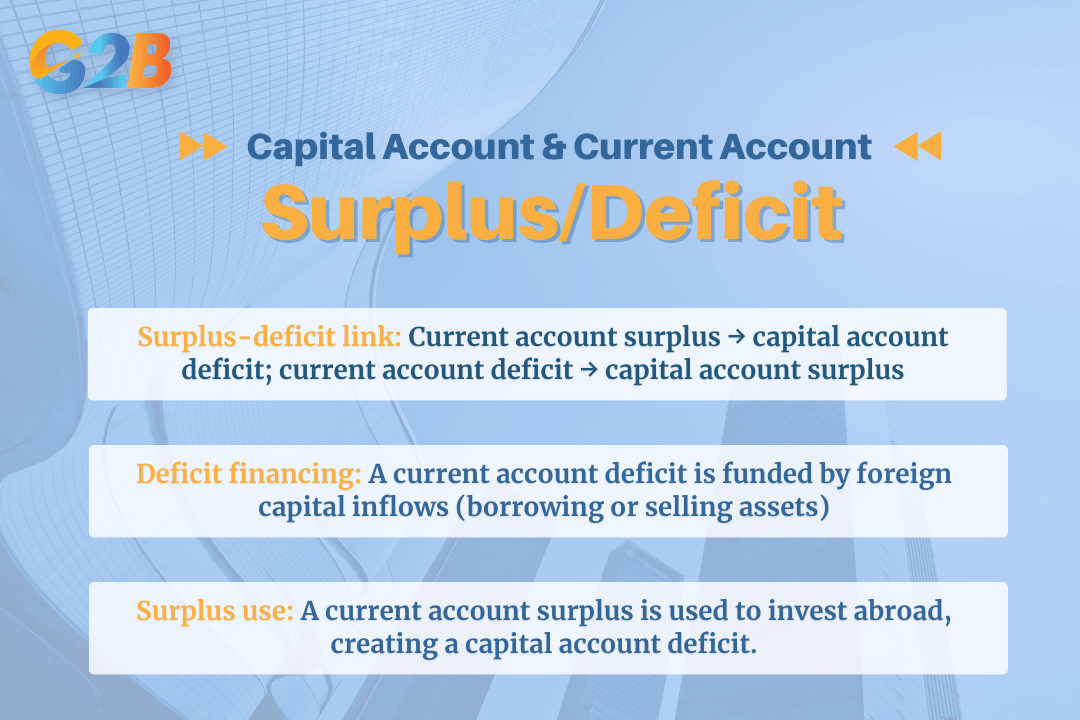

Surplus/Deficit

The offset principle has a direct and significant implication: A surplus in the current account is typically matched by a deficit in the capital account, and a deficit in the current account is matched by a surplus in the capital account. If a country spends more on foreign goods and services than it earns from its exports (a current account deficit), it must finance this shortfall. This financing comes from a net inflow of foreign capital, which means running a capital account surplus. Essentially, the country is borrowing from or selling assets to foreigners to pay for its excess imports. Conversely, a country with a current account surplus is earning more than it spends and uses this excess to invest abroad, resulting in a capital account deficit.

When the current account is in surplus, the capital account is in deficit and vice versa

Capital account surplus and deficit

The balance of the capital account, whether in surplus or deficit, provides a clear picture of the direction of net investment flows for a country. It indicates whether a nation is attracting more capital from the world than it is sending out, or vice versa. This balance is a key indicator of investor confidence and a country's financial relationship with other nations.

- Capital account surplus: A country has a capital account surplus when capital inflows are greater than capital outflows. This means more money is flowing into the country for investment and asset purchases than is flowing out. A surplus signifies that the nation is a net importer of capital. Foreigners are buying more of the country's assets (like stocks, bonds, and factories) than domestic residents are buying of foreign assets. This net inflow of foreign investment can be used to finance a current account deficit, where the country is importing more goods and services than it is exporting.

- Capital account deficit: A country has a capital account deficit when capital outflows are greater than capital inflows. This indicates that more money is leaving the country for investment abroad than is coming in. A deficit means the nation is a net exporter of capital. Its residents are investing more in foreign countries - by buying foreign assets, making loans, or building facilities abroad - than foreigners are investing in the domestic economy. A capital account deficit typically finances a current account surplus, where the nation earns more from exports than it spends on imports and invests the excess earnings overseas.

Causes of capital account surplus and deficit

The balance of a country's capital account is influenced by a multitude of economic and political factors that determine its attractiveness as an investment destination.

Reasons for surplus (Attracting capital inflow)

A capital account surplus occurs when a country is a magnet for foreign capital. Several factors can create this attractive environment:

- High real interest rates: When a country's real interest rates (nominal interest rates minus inflation) are high relative to other countries, it offers better returns on financial investments. This attracts a flow of "hot money" and portfolio investments from foreign investors seeking higher yields on assets like government bonds and savings accounts, leading to a capital inflow.

- Strong economic growth and stability: A robust and growing economy with a stable political environment boosts investor confidence. Foreign companies are more likely to make long-term Foreign Direct Investments (FDI) in a country with strong growth prospects, a skilled workforce, and predictable governance, as these factors promise higher and safer returns. In Vietnam, FDI plays a particularly crucial role in attracting the capital inflows that fuel Vietnam's economic growth and compensate for current account deficits.

- Expectations of currency appreciation: If investors believe a country's currency is going to increase in value, they will buy assets in that country. This allows them to benefit not only from the investment's return but also from the exchange rate gain when they convert the funds back to their currency. This expectation drives significant capital inflows.

- Open government policies and incentives: Governments can actively encourage foreign investment through favorable policies. Actions such as offering tax incentives, ensuring light regulation, creating special economic zones, and guaranteeing property rights make a country a more appealing destination for both direct and portfolio investment. Vietnam's targeted tax incentives and the establishment of special economic zones have been effective in attracting foreign capital.

- Healthy and transparent financial system: A well-regulated, transparent, and stable financial system is crucial. Investors need to trust that their assets are safe and that markets are fair. A country with strong banks, a reliable stock market, and clear accounting rules will naturally attract more foreign capital.

Reasons for deficit (Pushing capital outflow)

A capital account deficit happens when domestic capital flows abroad in search of better or safer opportunities. The primary drivers include:

- Political and economic instability: This is a major catalyst for capital outflows. Uncertainty, corruption, social unrest, or the risk of expropriation can cause investors to lose confidence in the domestic economy. This often leads to capital flight, where a large volume of assets and money rapidly flows out of a country.

- Low real interest rates: Just as high rates attract capital, low real interest rates repel it. If domestic investors can get significantly better returns on their savings and investments abroad, capital will naturally flow out of the country. This includes both individual investors and large institutional funds shifting their portfolios to higher-yielding foreign assets.

- Expectations of currency depreciation: If residents fear their home currency will lose value, they will rush to convert their money into foreign currencies or foreign assets to protect their wealth from devaluation. This anticipated depreciation can become a self-fulfilling prophecy as the act of selling the domestic currency puts further downward pressure on its value.

- Repayment of foreign debt: When a country's government or corporations make significant repayments on loans owed to foreign creditors, this represents a capital outflow. While a normal part of economic activity, a large wave of debt repayments can contribute significantly to a capital account deficit.

- Seeking growth opportunities abroad: In a mature or slow-growing economy, domestic companies and investors may look to emerging markets or other dynamic regions for higher growth prospects. This strategic outward investment in foreign companies, factories, and assets leads to a capital account deficit.

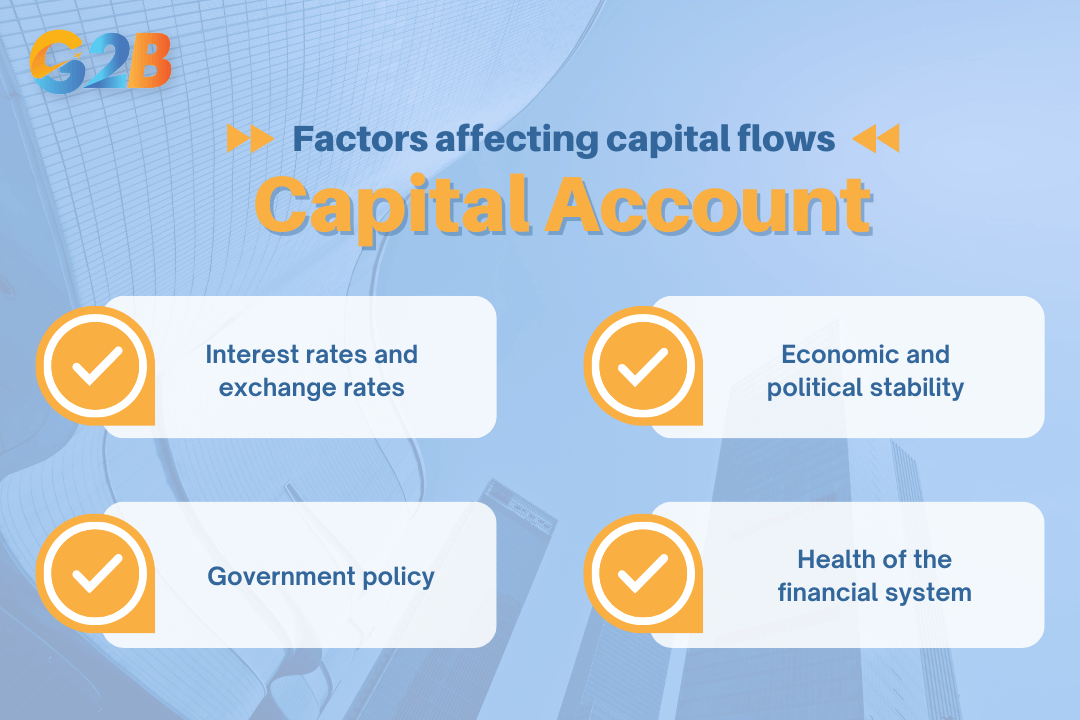

Factors affecting capital flows

Capital flows are dynamic and responsive to a range of interconnected macroeconomic factors. Investors, both domestic and foreign, constantly evaluate these conditions when deciding where to allocate their capital, influencing the capital account balance.

Capital flows are dynamic and responsive to a range of interconnected macroeconomic factors

Interest rates and exchange rates

The relationship between interest rates and exchange rates is a primary driver of short-term capital flows. Investors are naturally drawn to assets that offer the highest real returns. A country with high real interest rates will attract capital inflows as foreign investors seek better yields, pushing the capital account towards a surplus. This inflow increases demand for the domestic currency, often causing it to appreciate.

Conversely, low domestic interest rates encourage capital to flow out in search of better returns elsewhere, contributing to a deficit and a depreciating currency. Exchange rate expectations are equally powerful; if investors anticipate a currency will appreciate, they will buy that country's assets to profit from the rate change, creating an inflow. In Vietnam, the State Bank actively manages exchange rate policies to stabilize the currency and influence capital flows.

Economic and political stability

For long-term investments like FDI, stability is paramount. A predictable political environment, strong institutions, and a stable macroeconomic outlook reduce risk and build investor confidence. Countries that are perceived as stable and well-managed are more successful in attracting sustained capital inflows, which support long-run growth and a healthy capital account. In stark contrast, political instability, corruption, and economic mismanagement are major triggers of capital flight. The fear of a crisis or loss of assets can lead to a massive and sudden exodus of capital, causing a severe capital account deficit and destabilizing the entire economy.

Government policy

Governments can directly and indirectly influence capital flows through their policies. Pro-investment policies, such as tax incentives for foreign investors, deregulation, and strong legal protections for property rights, can significantly improve a country's capital account balance by attracting FDI and FPI. On the other hand, governments can also implement capital controls, which are direct measures to restrict the flow of capital across borders. These controls are often used as a last resort to prevent a capital account deficit, but they can also stifle economic growth by deterring legitimate investment.

Health of the financial system

The integrity and sophistication of a country's financial system are foundational to attracting and retaining foreign capital. A transparent, well-regulated, and stable financial system builds investor confidence. When banks are well-capitalized, stock markets are liquid and fair, and corporate governance standards are high, foreign investors feel secure in deploying their capital. This trust is a prerequisite for attracting stable, long-term investments and contributes directly to a capital account surplus. Conversely, a weak and opaque financial system, plagued by poor regulation and corruption, acts as a major deterrent. The risk of fraud, market manipulation, or a banking crisis will cause investors to stay away, leading to a capital account deficit.

Capital account liberalization

Capital account liberalization refers to the process of a country easing or removing its government-imposed restrictions on capital flows into and out of the country. It involves dismantling capital controls, such as limits on foreign investment, taxes on international financial transactions, and restrictions on citizens' ability to hold foreign assets. By opening up its capital account, a country aims to integrate more deeply with the global financial system, believing that the benefits of free capital movement will outweigh the risks. In Vietnam, capital account liberalization has proceeded cautiously with a gradual and controlled roadmap that balances the goals of macroeconomic stability, financial security, and sustainable growth. However, this is a delicate policy choice with significant potential upsides and downsides.

- Benefits:

- Attracts foreign investment: Liberalization is a powerful signal to the world that a country is open for business, which can attract a large volume of FDI and FPI needed to finance development and stimulate growth.

- Promotes financial market development: The inflow of foreign capital and the presence of foreign financial institutions can increase competition, efficiency, and sophistication in the domestic financial sector.

- Enables risk diversification: It allows domestic residents and companies to invest abroad, diversifying their portfolios and protecting them from purely domestic shocks.

- Risks:

- Increased vulnerability to global financial shocks: An open capital account exposes a country to volatility in the global financial system. A crisis in another part of the world can trigger a rapid outflow of capital, even if the domestic economy is fundamentally sound.

- Risk of "sudden reversal": The greatest danger is the risk of a sudden reversal of short-term capital inflows ("hot money"). This can lead to a currency collapse, a banking crisis, and a severe economic recession, as seen during the 1997 Asian Financial Crisis.

- Loss of monetary policy autonomy: Large and volatile capital flows can make it difficult for a central bank to control the money supply and set interest rates according to domestic economic needs.

The capital account provides a vital lens through which to view a country's economic relationship with the world. It meticulously records the net flow of investment capital, showing whether a nation is financing its growth with foreign funds or investing its savings abroad. This guide has explored the core components, the balancing relationship with the current account, and the profound economic consequences of a surplus or deficit. A surplus can fuel growth but risks inflation and instability, while a deficit often signals a loss of confidence and can lead to currency depreciation. An understanding and monitoring of the capital account are indispensable for crafting sustainable economic policy and ensuring long-term financial stability.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom