Face value is a fundamental concept in corporate finance that every entrepreneur and investor should understand. This nominal figure plays a critical role in the legal and accounting architecture of a company. Misunderstanding its purpose can lead to significant financial mistakes, particularly for startups during the crucial incorporation phase. This comprehensive guide will investigate its legal definition and accounting significance to the strategic process of choosing and setting the right par value for the company.

This article outlines the key aspects of face value to help businesses and investors gain a clearer understanding. We specialize in company formation and do not provide financial or investment advice. For specific guidance, please consult a qualified financial advisor or relevant institution.

What is face value?

Face value is the nominal value of a security stated in the local currency by its issuer in the legal documentation. Also known as "par value" or "nominal value", it is the value printed on the face of the certificate and represents the amount to be paid at maturity for bonds or the stated capital value for shares. This value remains fixed unless altered by a corporate action, such as a stock split.

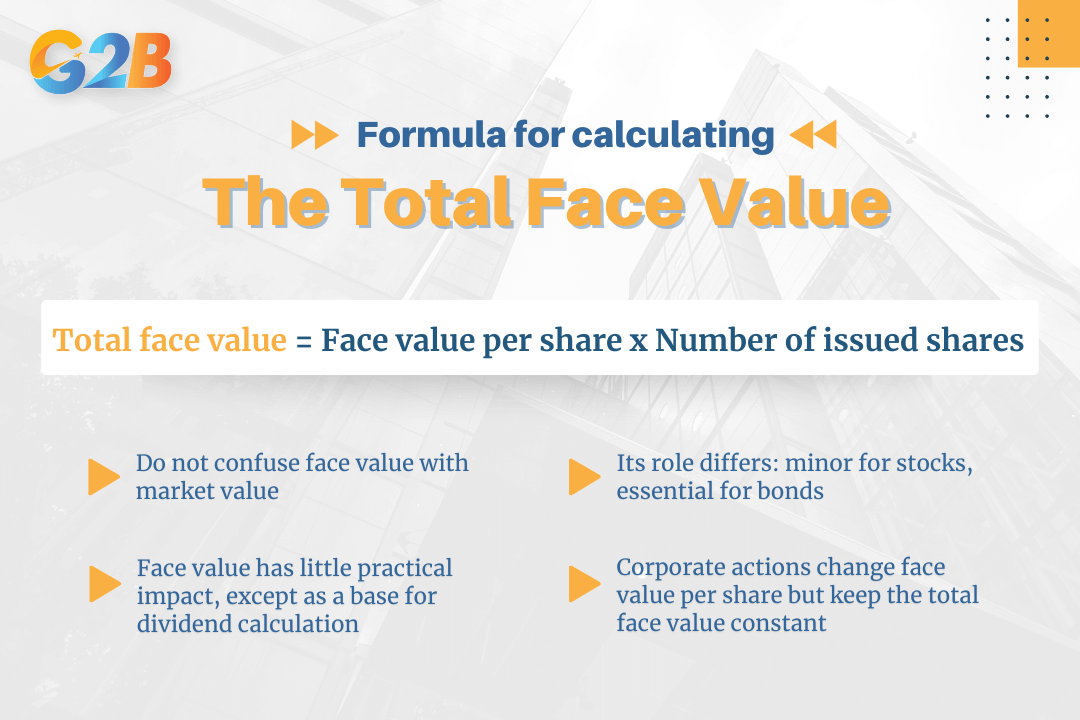

Formula for calculating the total face value

Total face value = Face value per share x Number of issued shares

Explanation of parameters

- Face value per share: This is the nominal value assigned to a single share of stock by a company in its corporate charter. It is a fixed, arbitrary amount (e.g., $0.01; ₹10; 10,000 VND) that is primarily used for legal and accounting purposes. This value is printed on the stock certificate and does not change unless the company undertakes a corporate action like a stock split.

- Number of issued shares: This represents the total number of shares that a company has issued, including those held by shareholders and those held as treasury shares by the company. This number can be found in a company's financial statements, specifically on the balance sheet within the shareholders' equity section. It is important to use the number of issued shares, not the number of authorized shares (the maximum number of shares the company is legally allowed to issue).

Caution when calculating

When calculating and interpreting the total face value, it is crucial to observe the following cautions:

- Do not confuse face value with market value: The most significant caution is not to mistake face value for market value. The face value is a static, nominal figure for accounting, while the market value is the dynamic price at which a stock trades on the open market, driven by supply and demand, company performance, and investor sentiment. The market value is what a stock is currently worth to an investor, and it can be substantially different from its face value. For example, a stock may have a face value of $0.00001 but trade at over $195 on the stock market.

- Understand its limited practical significance for investors: For the average investor, the face value of a stock has very little direct impact on its investment value. Its primary roles are in a company's internal accounting and legal structure. For instance, the total face value represents the legal capital of the company, which is the amount of equity that cannot be distributed as dividends.

- Use in dividend calculation: While not the sole determinant, face value is often the base upon which dividends are calculated. Companies typically declare dividends as a percentage of the face value. For example, a 50% dividend on a share with a 10,000 VND face value results in a 5,000 VND dividend per share, regardless of its higher market price.

- Context is key (Stocks vs. Bonds): The significance of face value differs between stocks and bonds. For stocks, it's largely an accounting formality. For bonds, the face value (or par value) is a critical component; it represents the principal amount that the issuer will repay to the bondholder at maturity and is used to calculate interest (coupon) payments.

- Impact of corporate actions: Events like a stock split will alter the face value per share. In a 2-for-1 split, the number of shares doubles, and the face value per share is halved, keeping the total face value of the company's stock constant. Always ensure you are using the current face value per share following any such corporate actions.

It is crucial to observe caution when calculating the total face value

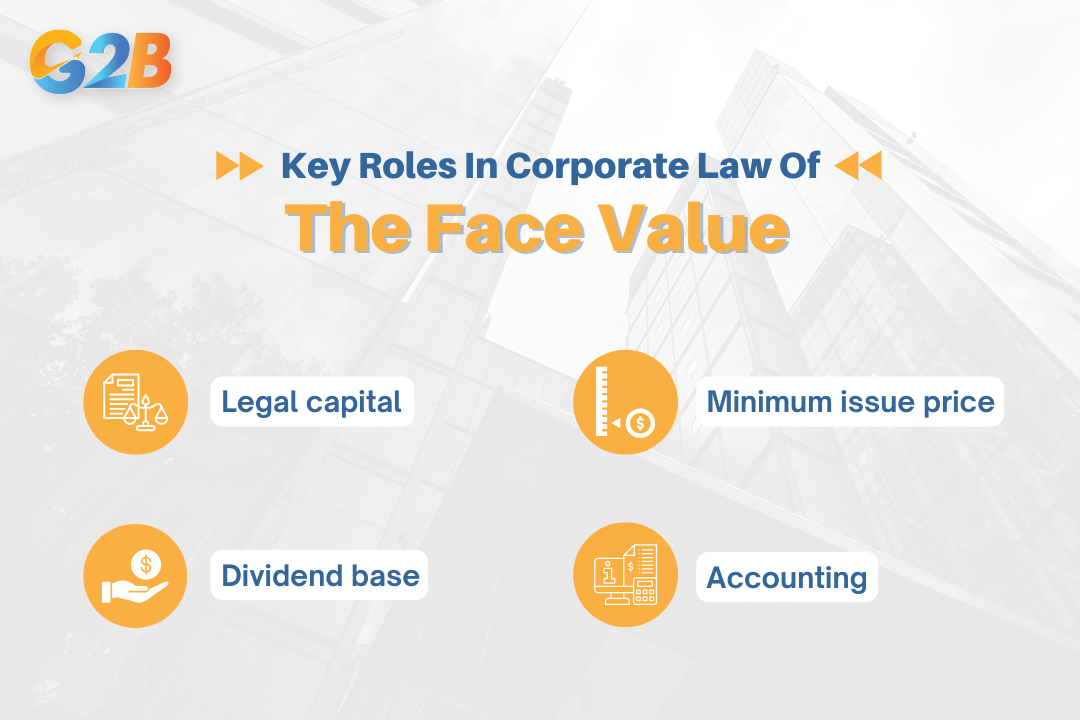

The legal and accounting significance of face value

The face value of a share, also known as par or nominal value, serves as a cornerstone for a company's legal and financial structure, despite not reflecting its market worth.

Legal capital and creditor protection

The total face value of all issued shares establishes the company's "legal capital". This is a legally mandated minimum amount of equity that must be retained by the company and cannot be distributed to shareholders as dividends. Its primary purpose is to act as a financial cushion, providing a measure of protection for the company's creditors.

Minimum share issuance price

Corporate law traditionally dictates or, in some jurisdictions, requires that a company cannot issue shares for a price below its stated face value, although this rule may not apply universally due to the existence of no-par value shares in modern corporate laws. This rule was originally intended to ensure that all initial shareholders bought into the company at a fair and consistent minimum price. When shares are sold for more than their face value, the excess amount is recorded separately in the company's books.

Basis for dividend calculation

Dividends are frequently declared as a percentage of a share's face value, not its fluctuating market value. For instance, a 100% dividend declared on a share with a ₹10 face value would result in a ₹10 dividend payment per share, even if that share is trading on the stock market for ₹500.

Accounting and financial reporting

In accounting, the face value is fundamental. It is used to record the stock's value on the balance sheet within the shareholders' equity section. The total par value of issued stock is recorded in the "Common Stock" account. Any amount received from investors above the par value is recorded in an account called "Additional paid-in capital" or "Share Premium."

The face value of a share serves as a cornerstone for a company's legal and financial structure

How to choose the right face value?

Selecting the right face value during company formation is a critical strategic decision, especially for startups. The overwhelming advice from legal and financial experts is to set an extremely low par value. This choice has significant implications for founder investment, future fundraising, and annual tax obligations.

The case for a low par value

Setting a par value at a small fraction of a cent, such as $0.0001 or $0.00001, is standard and highly recommended practice for new ventures. This approach provides several distinct advantages.

First, it minimizes the initial cash investment required from founders to purchase their equity. For example, if a company issues 8 million shares to its founders at a par value of $0.00001, the total cost is a manageable $80. If the par value were set at $1.00, the founders would be legally obligated to pay $8 million to the company for their stock, an impractical and unnecessary financial burden.

Second, a low par value provides maximum flexibility for future financing rounds. The company can sell shares to venture capitalists and other investors at a much higher market price without any legal or accounting complications. The difference between the low par value and the higher issue price is simply recorded as "Additional Paid-In Capital" on the balance sheet.

Third, and perhaps most importantly for companies incorporating in popular states like Delaware, a low par value can lead to significant savings on annual franchise taxes. Delaware calculates franchise tax using two methods: the Authorized Shares Method and the Assumed Par Value Capital Method. The state defaults to the method that yields a higher tax bill, which for startups with a large number of authorized shares is almost always the Authorized Shares Method. However, by setting a low par value, companies can use the Assumed Par Value Capital Method to dramatically reduce their tax liability, often from tens of thousands of dollars to the minimum tax of a few hundred dollars.

The pitfalls of high and no-par value

Conversely, choosing a high par value (e.g., $1.00 per share) is a common mistake that can force founders to make a substantial and often unnecessary cash payment to the company for their initial shares. This creates a significant barrier to entry and offers no tangible benefit, as the par value has no connection to the company's actual market valuation.

While some states permit the issuance of "no-par value" shares, this can sometimes be a trap. It might seem simpler, but it can lead to a much higher franchise tax bill in key incorporation states like Delaware. For entrepreneurs looking to register a company in Delaware, it is important to understand that when using the Authorized Shares Method for tax calculation, no-par shares can result in a tax liability that is thousands of dollars higher than for a company with a low par value. This makes the no-par option financially unattractive for most startups that plan to authorize a large number of shares for future growth.

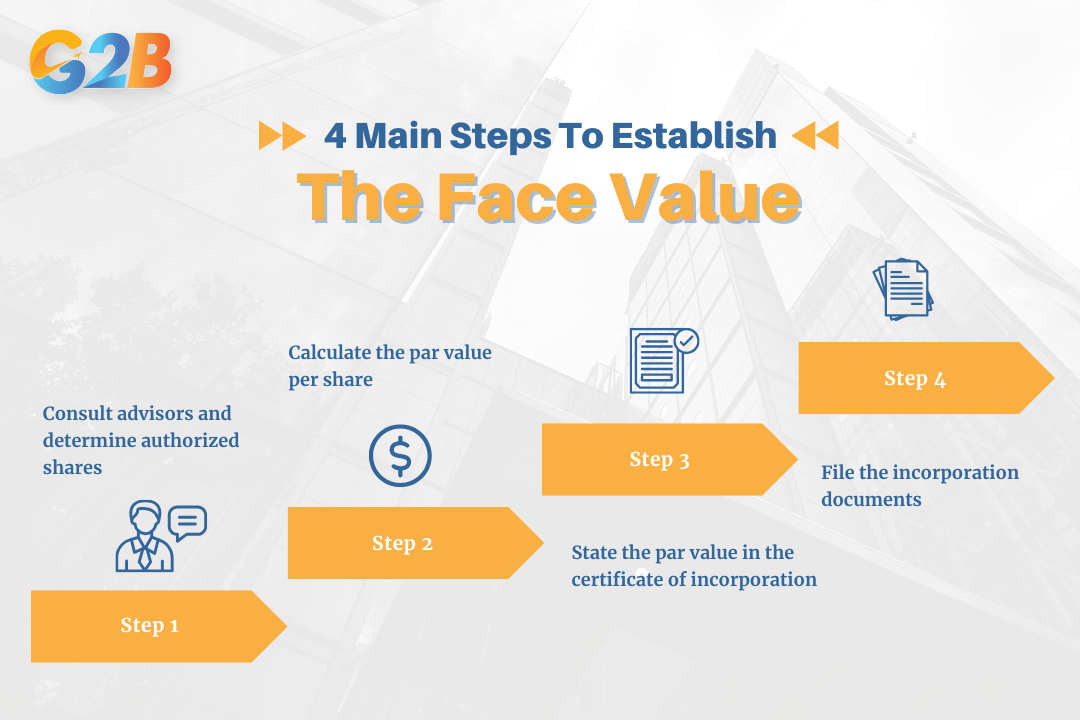

How to set up the face value?

Establishing the face value is a formal, multi-step process undertaken when a company is legally formed. It's a foundational decision that is embedded in the company's core legal DNA. Getting it right from the start is essential to avoid future complications and costs associated with amending legal documents.

Step 1: Consult advisors and determine authorized shares

Before any value is set, founders must make two key decisions with professional guidance.

First, consult with a corporate lawyer or a specialized incorporation service. This is not a step to be taken lightly. A legal professional can provide crucial guidance on the specific implications of par value in your chosen state of incorporation. They will understand the nuances of state corporate law and tax codes, such as the Delaware franchise tax, ensuring you make the most financially sound decision.

Second, decide on the total number of shares the company will be authorized to issue, which is the maximum number of shares the company is legally permitted to issue according to its corporate charter. This is the maximum number of shares your company is legally allowed to sell. For technology startups and other high-growth companies, a common starting point is 10,000,000 authorized shares. This large number isn't for immediate sale; rather, it provides ample room for future needs, including issuing stock to founders, creating an equity incentive plan for employees (stock option pool), and raising capital from investors in multiple financing rounds without needing to amend the corporate charter.

Step 2: Calculate the par value per share

With the number of authorized shares decided, you can now calculate an appropriate par value. The goal, as established, is to set a very low value. A common and sound practice is to work backward from a nominal total par value, such as $100 or $1,000, which represents the initial legal capital of the company.

The calculation is: Total desired par value / Number of authorized shares = Par value per share.

For example, using the standard 10 million authorized shares and a desired total par value of $100, the calculation would be: $100 / 10,000,000 shares = $0.00001 per share.

This figure, $0.00001, becomes the official face value. It's a number that satisfies legal requirements while keeping the initial purchase cost for founders extremely low and optimizing for tax efficiency.

Step 3: State the par value in the certificate of incorporation

The chosen face value must be formally documented in the company's primary formation document, the Certificate of Incorporation (also known as the Articles of Incorporation). This legal document is the company's constitution. Within this document, there will be a specific section detailing the company's stock structure. This clause must explicitly state both the total number of authorized shares the company can issue and the par value of each share.

Step 4: File the incorporation documents

The final step is to file the completed Certificate of Incorporation with the Secretary of State (or equivalent government body) in the state where the company is being formed. This official filing legally creates the corporation. Once the state accepts and files the document, the company's existence is recognized, and the stated number of authorized shares and their designated face value become official. Amending this value later is possible but requires a formal corporate action, including board and shareholder approval, and paying additional filing fees, making it crucial to set it correctly from the outset.

There are 4 main steps to establish the face value

Face value and stock shares

It is crucial to differentiate face value from other key stock valuation metrics. Their meanings and applications are distinctly different, and confusing them can lead to flawed analysis and poor investment decisions. Face value is a legal and accounting formality, not a measure of a stock's true market worth.

| Metric | Definition | Purpose & characteristics |

|---|---|---|

| Face value | The nominal, fixed value of a share as stated in the company's charter. | Used for legal and accounting purposes. Does not change unless there is a corporate action (e.g., stock split). Has no bearing on the stock's trading price. |

| Market value | The current price at which a share is traded on the open stock market. | Determined by supply and demand, company performance, and investor sentiment. It is dynamic and fluctuates constantly. This is the "real" value for an investor. |

| Issue price | The price at which a company first sells its shares to investors, such as during an Initial Public Offering (IPO). | Set by the company and its underwriters. It is almost always significantly higher than the face value. |

| Book value | The company's net asset value per share (Total assets - Total liabilities) / Number of issued Shares. | An accounting measure that represents the theoretical value of a share if the company were to be liquidated. |

Face value is a foundational pillar in the architecture of corporate finance, serving a distinct legal and accounting purpose rather than acting as a measure of investment worth. While investors should recognize that face value has no bearing on a stock's market price or intrinsic worth, understanding its function is essential for interpreting financial statements and corporate actions.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom