Stock taking in Vietnam is not merely a compliance requirement but a practical management tool that helps businesses in Vietnam maintain inventory control, improve operational efficiency, and identify discrepancies between physical stock and accounting records. For foreign-invested enterprises, especially in manufacturing and trading, a well-structured stock take supports audit readiness, risk management, and compliance with local accounting and tax regulations. More importantly, it provides valuable insights into inventory performance, helping reduce losses, control costs, and optimize procurement, production, and warehouse planning.

This article highlights the key aspects of effective stock taking to help businesses gain a clearer understanding of inventory management practices in Vietnam. We specialize in company formation in Vietnam and not provide auditing advisory services. For detailed stock audit matters, please consult a qualified auditor.

The importance of stock taking in Vietnam

Stock taking acts as the primary validation mechanism between the physical reality of a business and its recorded financial data. In Vietnam, this process is not optional; it is primarily governed by the Law on Accounting No. 88/2015/QH13, along with detailed requirements under Circular 200/2014/TT-BTC (on enterprise accounting regime) and Circular 133/2016/TT-BTC (for SMEs).

Ensuring the accuracy of these reports is a fundamental responsibility of every legal entity operating within the country.

Statutory compliance and legal liability

The Vietnamese authorities view the inventory report as a binding legal document. Foreign-Invested Enterprises must produce accurate "Minutes of Inventory Counting" to satisfy external audits and tax inspections. Discrepancies found during a tax audit can lead to severe consequences. If the physical stock is lower than the accounting records, tax authorities often deem the shortage as unrecorded sales, leading to immediate arrears collection on Corporate Income Tax (CIT) and Value Added Tax (VAT), plus substantial administrative penalties.

Financial integrity and operational control

From a management perspective, rigorous stock taking detects inefficiencies such as theft, spoilage, obsolescence, and mismanagement. Accurate data ensures that the Balance Sheet and Income Statement present a true and fair view of the company’s financial health. For FIEs, where headquarters may be located overseas, the stock take provides the necessary transparency to validate local management performance.

The importance of stock taking in Vietnam

Mandatory timing for stock taking

The timing of inventory counting is not arbitrary. Circular 200/2014/TT-BTC and Circular 133/2016/TT-BTC, in line with the Law on Accounting, dictate specific instances when an enterprise must conduct a physical count to verify the quantity and value of assets.

Annual accounting period end

December 31st is the mandatory closing date for the fiscal year for all businesses in Vietnam unless otherwise registered. Consequently, most comprehensive stock takes occur in late December or early January to align with the fiscal year-end. If an FIE has registered a different fiscal year (e.g., ending March 31st or June 30th) with the Tax Department, the stock take must coincide with that specific reporting date.

Corporate restructuring and changes

Enterprises must also perform stock taking during significant structural changes, including:

- Division, de-merger, consolidation, or merger of the enterprise.

- Dissolution or bankruptcy proceedings.

- Ownership changes (sale of the business).

- Leasing of the enterprise.

In cases of mergers and acquisitions, a thorough stock take is a non-negotiable step in the due diligence process to verify asset valuation

Extraordinary circumstances

Stock taking is mandatory immediately following natural disasters, fires, or unforeseen events that affect asset integrity. This establishes the value of damages for insurance claims and tax deductibility purposes. Furthermore, stock taking is required upon a decision by a competent state authority, such as an inspection by the Department of Planning and Investment or the Tax Department.

Assets and inventory are subject to stock taking

A comprehensive stock take extends beyond verifying merchandise for sale. Circular 200/2014/TT-BTC outlines that the inventory process must cover all assets under the company's ownership and custody.

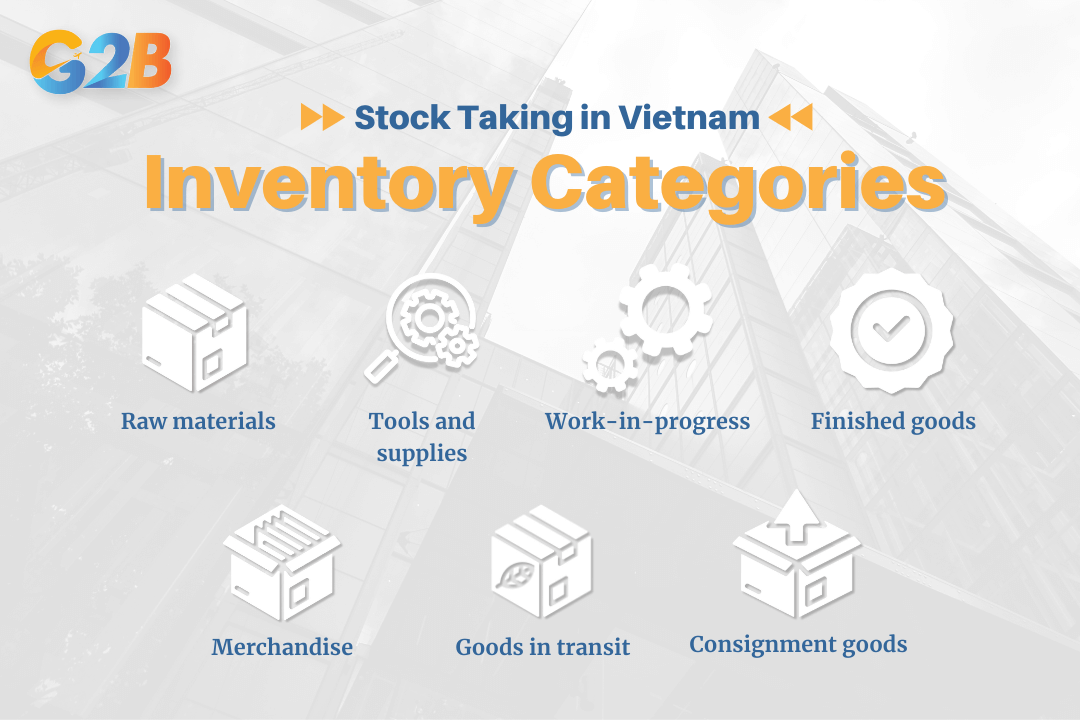

Inventory categories

The physical count must encompass all classes of inventory, including:

- Raw materials: Basic inputs used in production.

- Tools and supplies: Consumables and small equipment not qualifying as fixed assets.

- Work-in-progress (WIP): Unfinished goods currently in the manufacturing line.

- Finished goods: Products ready for sale.

- Merchandise: Goods purchased for resale without processing.

- Goods in transit: Items purchased but not yet received (verified via documentation).

- Consignment goods: Inventory sent to agents for sale.

The physical count must encompass all classes of inventory

Fixed assets

Enterprises must verify tangible fixed assets (machinery, buildings, vehicles) and intangible fixed assets (software, patent rights). The count verifies existence and assesses the current condition to determine if impairment or accelerated depreciation is necessary. Proper management of these assets is essential for maintaining a balanced capital structure

Cash and monetary funds

The stock take includes the physical counting of cash on hand (audit of the cash fund) and reconciliation of cash at the bank via bank confirmation letters. This process ensures that all funds in the accounts established during the opening a bank account in Vietnam phase are fully accounted for

Third-party assets

Assets held by the enterprise but owned by others (e.g., goods received for processing, goods kept on behalf of others) must also be counted and recorded separately to ensure clear demarcation of ownership.

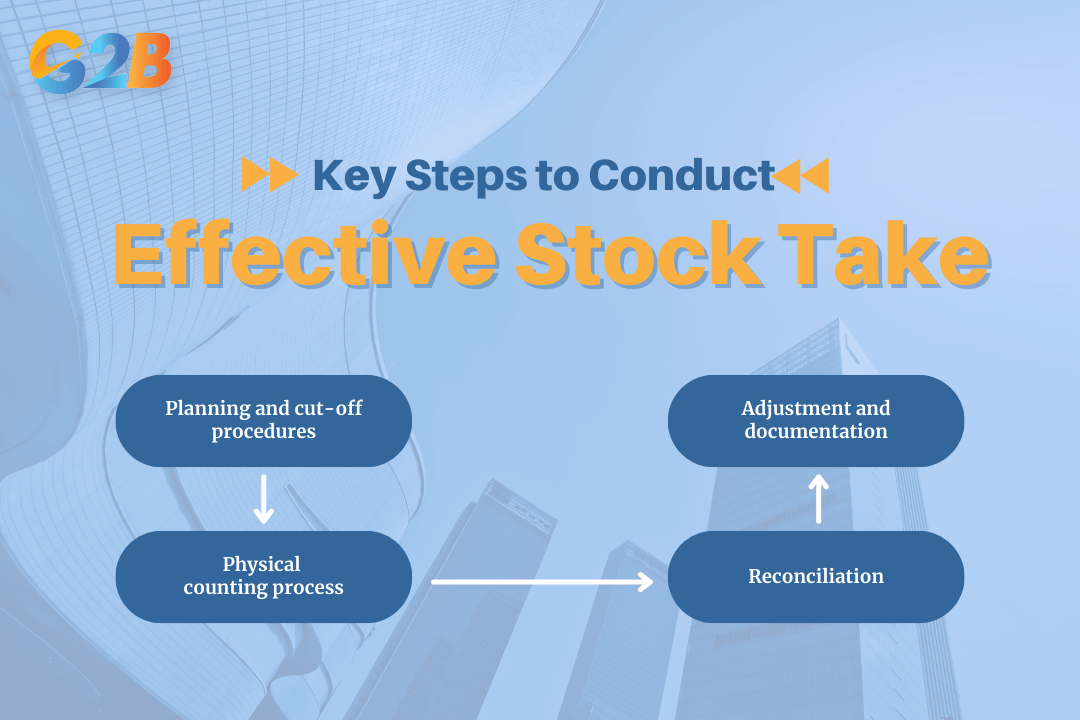

Key steps to conduct an effective stock take

To ensure the results are valid and acceptable to external auditors, FIEs must follow a structured workflow.

FIEs must follow a structured workflow of 4 steps

1. Planning and cut-off procedures

Preparation is the determinant of success. Management must issue an official Inventory Counting Decision establishing the inventory committee. Crucially, the company must implement cut-off procedures.

- Sales and purchasing stop: Operations should cease or be strictly controlled during the count.

- Document control: Identify the last Goods Receipt Note (GRN) and Goods Issue Note (GIN) issued before the count begins to establish a clear boundary for the accounting period.

2. Physical counting process

The inventory committee, usually comprising the department staff, storekeepers, and independent observers (often external auditors), conducts the count.

- Blind counts: Counters should ideally not see the book quantities beforehand to prevent bias.

- Tagging system: Use pre-numbered tags to mark counted items, preventing double-counting or omission.

- Condition assessment: Simultaneously note damaged or obsolete items for potential liquidation or provision for devaluation.

3. Reconciliation

Upon completion, the committee compares the physical count results with the accounting records (ERP/Ledger).

- Variance analysis: Investigate all discrepancies.

- Surplus: If physical > book, identify if the cause is unrecorded receipts or incorrect issuing.

- Shortage: If physical < book, identify if the cause is theft, unrecorded sales, or wastage.

4. Adjustment and documentation

The final step involves processing adjustments in the accounting books to match the physical reality.

- Minutes of inventory counting: A formal report signed by all committee members. This is a mandatory legal document.

- Treatment of differences: Management must decide on the treatment of shortages (e.g., charging the employee responsible or writing off as an expense) in accordance with the Law on Accounting.

Practical considerations for foreign-invested enterprises

FIEs face unique challenges when conducting stock takes in Vietnam due to cross-border reporting requirements and local regulatory nuances.

Language and currency differences

Documentation must be maintained in Vietnamese. While FIEs often use English for internal reporting, the Minutes of Inventory Counting prepared in Vietnamese for official records and inspections must be in Vietnamese.

Alignment with global fiscal years

Many FIEs operate on a global fiscal year (e.g., ending Sept 30), different from the Vietnamese standard (Dec 31). While the Ministry of Finance allows FIEs to adopt their global fiscal year (upon notification), the enterprise must ensure the stock take aligns exactly with the registered year-end. Failure to align the stock take date with the registered financial year-end results in invalid audit evidence.

External audit requirements

For FIEs, an annual audit by an independent auditing firm is mandatory. External auditors require their presence at the year-end stock take to sign off on the process.

- Scheduling conflicts: FIEs must coordinate early with their auditors, as the period between Dec 25 and Jan 5 is peak season. The chief accountant in Vietnam plays a pivotal role in organizing this coordination and ensuring the inventory minutes are audit-ready

- Signatures: Ensure the auditor signs the physical count sheets; otherwise, the audit opinion may be qualified (a "red flag" for investors and banks).

Managing work-in-progress (WIP)

For manufacturing FIEs, counting WIP is complex. The enterprise must have a consistent method for estimating the percentage of completion for unfinished goods. Arbitrary estimation of WIP is a common area where tax authorities challenge the Cost of Goods Sold (COGS) calculations.

Additional references and professional support

Accurate stock taking is not merely a box-ticking exercise; it is the mechanism that safeguards your assets and ensures your tax position is defensible. The Ministry of Finance and local tax departments rely heavily on these records during inspections. Errors here can lead to the rejection of deductible expenses and the imposition of back taxes.

Completing an effective stock-taking process in Vietnam is not only a compliance requirement but also a strategic tool for improving operational efficiency and financial accuracy. This procedure is a vital component of the overall company setup process and requirements in Vietnam, ensuring long-term operational transparency. By applying proper planning, clear procedures, accurate documentation, and internal controls, businesses can minimize discrepancies, prevent losses, and maintain transparent inventory records.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom