In a dynamic business landscape, understanding the different types of corporate structures is crucial for entrepreneurs, investors, and business professionals. Among these structures, Berhad (BHD) stands out as the primary vehicle for large-scale business operations and public investment in Malaysia. This comprehensive guide examines the intricacies of Berhad companies, their fundamental differences from private limited companies, and how they compare to similar structures in neighbouring countries, such as Vietnam.

What is Berhad (BHD)

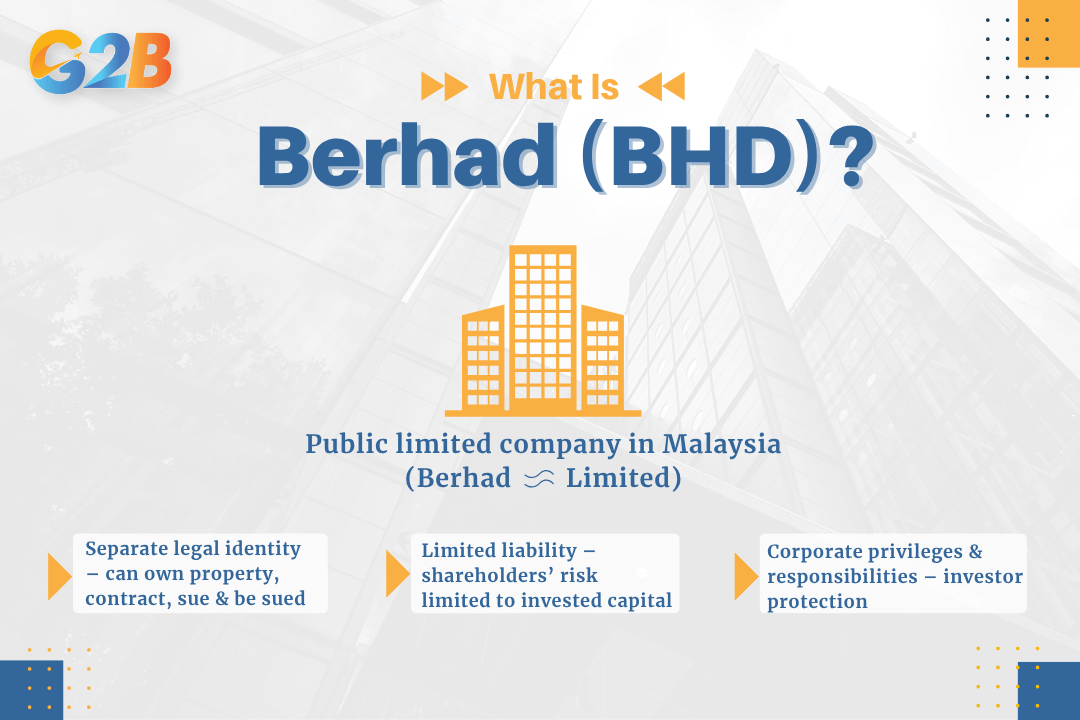

Berhad (abbreviated as BHD) is a term used in Malaysia to refer to a public limited company. In Malay, "Berhad" means "limited," similar to "Ltd" in English. A Berhad company has a separate legal identity, can own property, enter into contracts, sue, and be sued. Shareholders' liability is limited to the amount of capital they have invested, providing crucial protection for investors while enabling businesses to operate with corporate privileges and responsibilities.

Berhad structure offers compelling advantages for large-scale business operations in Malaysia

Role and benefits of a Berhad company

The Berhad structure offers several compelling advantages that make it the preferred choice for large-scale business operations in Malaysia:

- Capital raising capability: Enables businesses to raise substantial capital by issuing shares, providing access to broader financial markets and investment opportunities.

- Business expansion potential: Increases potential for business expansion and scaling operations through enhanced access to funding and corporate credibility.

- Investor confidence: Builds investor confidence through legal accountability and financial transparency, making it easier to attract both domestic and international investors.

- Risk protection: Protects shareholders from personal financial liability beyond their initial investment, encouraging more people to invest in business ventures.

- Corporate legitimacy: Establishes strong corporate legitimacy and recognition in the marketplace, facilitating better business relationships and opportunities.

Real-world examples of notable Berhad companies in Malaysia

Malaysia's economy is powered by numerous successful Berhad companies across various sectors:

- Maybank Berhad - the largest bank in Malaysia and one of the leading financial institutions in Southeast Asia

- Petronas Chemicals Group Berhad - a chemical company under the national oil and gas group Petronas

- Genting Berhad - a well-known multinational corporation in entertainment and hospitality

- CIMB Group Holdings Berhad - a major financial services provider with regional presence

- Public Bank Berhad - one of Malaysia's largest banks by market capitalization

- Tenaga Nasional Berhad - Malaysia's largest electricity utility company

- Axiata Group Berhad - a leading telecommunications conglomerate in Asia

- IHH Healthcare Berhad - one of the world's largest healthcare operators

- Sime Darby Berhad - a diversified multinational corporation

- Kuala Lumpur Kepong Berhad - a major plantation and manufacturing company

Key differences between Berhad (BHD) and sendirian Berhad (SDN BHD)

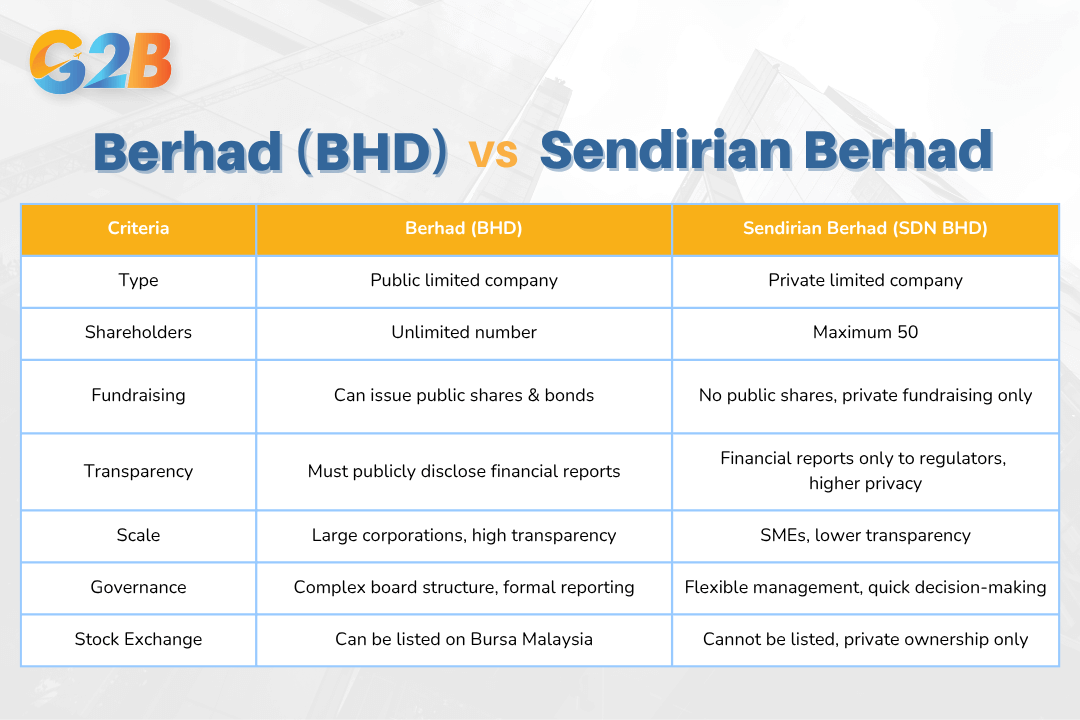

Sendirian Berhad (SDN BHD) is a private limited company, not permitted to issue shares to the public and restricted to a limited group of shareholders. Understanding the distinctions between these two corporate structures is essential for making informed business decisions.

There are several differences between Berhad and Sendirian Berhad

Number of shareholders

The shareholder capacity represents one of the most fundamental differences between these corporate structures. BHDs can have an unlimited number of shareholders, making them suitable for large-scale companies that require extensive capital and diverse ownership. SDN BHDs are capped at 50 shareholders, making them ideal for small and medium-sized enterprises (SMEs) that prefer closer control and limited ownership circles.

Share issuance and fundraising ability

Capital raising capabilities differ significantly between the two structures. BHD companies are allowed to issue shares and bonds to the public, making it easier to raise large-scale capital from financial markets and institutional investors. SDN BHD companies are not allowed to issue public shares, with share transfers being restricted and requiring approval from existing shareholders, limiting their fundraising options to private arrangements.

Disclosure and financial reporting requirements

Transparency obligations vary considerably between the two company types. BHD companies must publicly disclose financial reports and important company information, subject to stricter transparency and regulatory scrutiny from various authorities. SDN BHD companies are only required to submit financial reports to regulatory bodies and are not obligated to publicly disclose financial details, maintaining greater privacy in their operations.

Scale and transparency

Operational scale and transparency requirements reflect the different nature of these business structures. BHD companies are typically large corporations with high transparency requirements, subject to oversight by the stock exchange and financial regulators. SDN BHD companies are primarily SMEs with lower transparency requirements, making them suitable for closely held shareholder groups who value privacy and control.

Governance and decision-making

Management complexity differs based on the corporate structure and stakeholder base. BHD companies have governance processes that are more complex due to a larger shareholder base and public disclosure requirements, necessitating formal board structures and comprehensive reporting. SDN BHD companies have a more flexible management structure, making them easier to control and maintain internal confidentiality while enabling quicker decision-making processes.

Stock exchange listing eligibility

Market access represents another crucial distinction between these corporate forms. BHD companies can be listed or unlisted on the Malaysian stock exchange (Bursa Malaysia), providing opportunities for public trading and enhanced liquidity. SDN BHD companies are not allowed to be listed on a stock exchange, limiting their access to public capital markets but maintaining operational privacy.

Comparison between Berhad (BHD) in Malaysia and a Joint Stock Company in Vietnam

Joint Stock Company (JSC) in Vietnam is a business structure where the charter capital is divided into equal shares, and shareholders are only liable up to the amount of their capital contribution. This structure closely resembles Malaysia’s BHD format. For foreign investors seeking a similar corporate model, registering a company in Vietnam can be a great option, as the country offers attractive policies for overseas businesses.

Number of shareholders and fundraising ability

The comparison reveals interesting similarities and differences in shareholder requirements and capital raising capabilities:

| Criteria | Berhad (BHD) - Malaysia | Joint Stock Company - Vietnam |

|---|---|---|

| Number of shareholders | Minimum of 2, no maximum | Minimum of 3 (founding), no maximum |

| Share issuance | Can issue to the public, often listed on stock exchange | Can issue to the public, can be listed on stock exchange |

| Capital raising | Highly flexible, easy to raise large funds via share issuance | Flexible, capable of large fundraising through share issuance |

Governance structure

Corporate governance frameworks reflect the regulatory environments and business cultures of each country. Berhad (BHD) companies are governed by a Board of Directors, General Meeting of Shareholders, and an Executive Team. They are required to hold annual general meetings and publicly disclose financial reports, with regulation provided by the Securities Commission Malaysia.

Joint Stock Company - Vietnam operates under a governance structure that includes a General Meeting of Shareholders, Board of Directors (with minimum 3 members), and a Supervisory Board (mandatory if there are over 11 shareholders or an entity owns more than 50% of shares), plus a General Director. This flexible structure is suitable for various company sizes and is regulated by the Vietnam State Securities Commission for public companies.

Shareholder rights and obligations

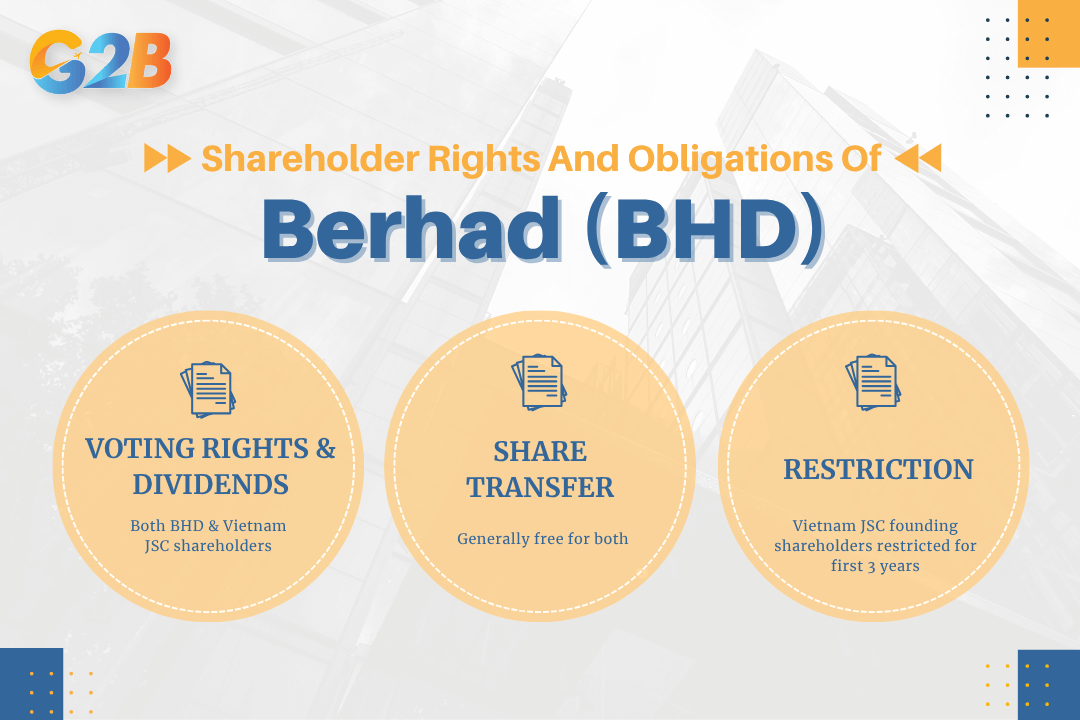

Investor protections and rights demonstrate the mature regulatory frameworks in both countries. BHD shareholders have voting rights based on their shares, receive dividends, and can freely transfer shares unless restricted by the company charter. Vietnam JSC shareholders similarly have voting rights, receive dividends, and can transfer shares freely, though founding shareholders may face restrictions on share transfers within the first 3 years from the date of issuance of the business registration certificate.

Investor protections and rights demonstrate the mature regulatory frameworks in both countries

Disclosure and transparency

Transparency requirements reflect the commitment to investor protection in both jurisdictions. BHD companies must disclose financial statements, corporate governance details, and major events to the public, ensuring high transparency for investor protection. Vietnam JSC public companies must disclose financial reports, governance information, and major transactions as required by securities law, maintaining similar transparency standards.

Legal liability

Both corporate structures provide similar investor protections through limited liability frameworks. BHD shareholders have limited liability within their contributed capital, protecting personal assets from corporate debts. Vietnam JSC operates under the same principle - shareholders are only liable up to the value of their capital contributions, providing equivalent protection for investors.

Notable differences

Several key distinctions emerge when comparing these corporate structures across jurisdictions. Legal framework differences show that BHDs comply with the Malaysian Companies Act and stock exchange regulations, while JSCs follow Vietnam's Enterprise Law 2020, Securities Law, and stock exchange regulations. Formation requirements differ slightly, with BHDs requiring at least 2 shareholders while JSCs require a minimum of 3 founding shareholders.

Share transferability shows that BHD shares are generally freely transferable, while Vietnam JSCs may restrict share transfers for founding shareholders within the first 3 years from the date of establishment. Disclosure obligations are similar for both structures, with BHDs (if listed) subject to strict financial transparency requirements, and public JSCs in Vietnam having similar disclosure requirements under their securities regulations.

Understanding the Berhad (BHD) corporate structure is essential for anyone involved in Malaysian business, whether as an entrepreneur, investor, or corporate professional. This comprehensive examination has revealed the significant advantages that BHD companies offer, from enhanced capital-raising capabilities to improved market credibility and regulatory protection.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom