A consignment invoice serves as a vital commercial document that bridges the gap between shipment and final sale, ensuring transparency and proper record-keeping throughout the consignment process. G2B recognises that mastering consignment invoice management is essential for maintaining healthy business relationships and regulatory compliance, particularly in today's complex international trade environment - especially for those looking to register a company in Vietnam and engage in cross-border trade effectively.

This article outlines essential aspects of consignment invoices to provide businesses with a clearer understanding of their role and practical applications in consignment trading. We specialize in company formation and do not offer legal or financial advice. For tailored strategies or compliance-related matters concerning consignment transactions, please consult a qualified legal or logistics expert.

What is a consignment invoice?

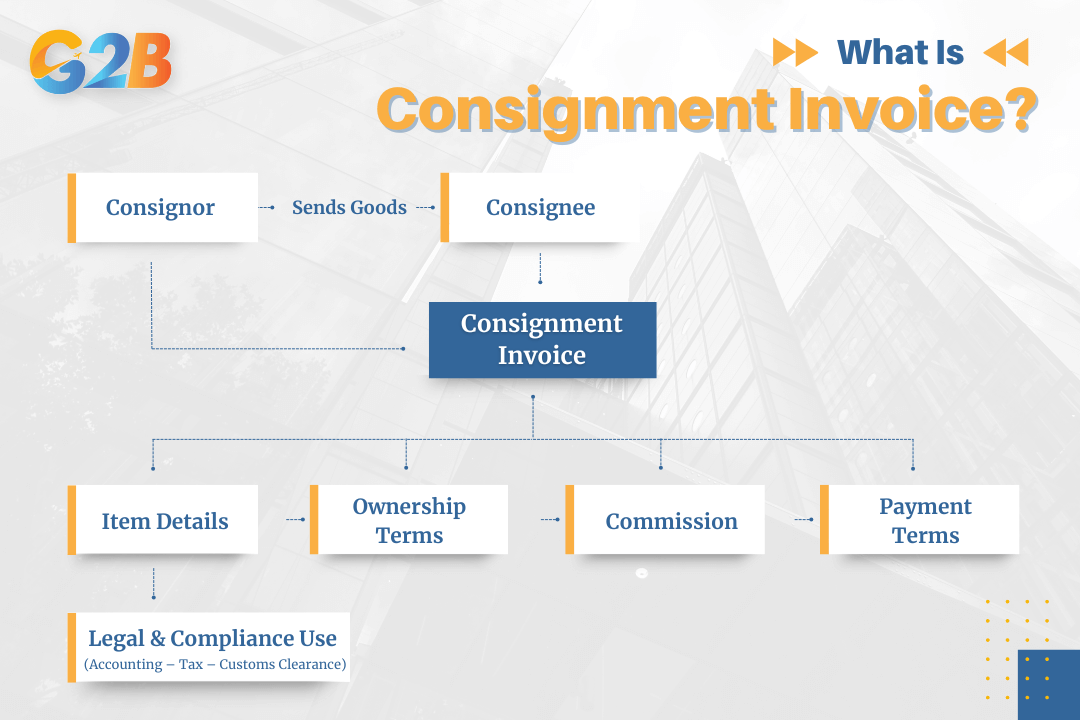

A consignment invoice is a commercial document provided by the consignor (seller) to the consignee (buyer or agent), detailing goods sent for sale under a consignment agreement where the goods remain owned by the consignor until sold. This invoice serves important functions in business transactions and inventory management, primarily clarifying the details and conditions under which the goods are transferred. Unlike traditional sales invoices, consignment invoices reflect a unique arrangement where the risk and ownership of goods remain with the consignor until the final customer purchases the items.

Read more: A Detailed Comparison Between a Consignment Invoice and a Bill of Lading

The consignment invoice acts as a comprehensive record that outlines the terms of the consignment agreement, including the specific goods being consigned, their estimated values, commission structures, and payment terms. This document ensures that both parties understand their responsibilities and obligations throughout the consignment period. It serves as legal proof of the consignment arrangement and provides essential information for accounting, tax reporting, and customs clearance purposes when goods cross international borders.

A consignment invoice is a commercial document provided by the consignor to the consignee

Roles and functions of a consignment invoice

The consignment invoice fulfils several critical roles in business operations:

- Proof of shipment & ownership: Specifies ownership of goods remains with the consignor until sale, providing clear legal documentation of the consignment arrangement and protecting both parties' interests in case of disputes or complications, but does not serve as proof of shipment.

- Financial record: Provides a breakdown of the transaction for accounting and taxation purposes, enabling proper bookkeeping and ensuring compliance with financial reporting requirements while maintaining accurate records of consigned inventory values.

- Customs valuation: Used by customs authorities to assist in understanding the consignment arrangement, but the commercial invoice is primarily used for customs valuation to determine duties and taxes, facilitating smooth international trade operations and ensuring accurate assessment of import/export obligations.

- Transparency: Ensures both parties (consignor and consignee) have a clear record of consigned items, fostering trust and reducing potential misunderstandings about quantities, values, and terms of the consignment agreement.

- Inventory management: Assists in tracking goods in transit or unsold items, enabling better inventory control and helping businesses make informed decisions about restocking, pricing, and sales strategies.

- Payment terms: Lays out the agreement regarding sale proceeds, commissions, and remittance, establishing clear expectations for financial settlements and ensuring timely payments between consignor and consignee.

What does a consignment invoice include?

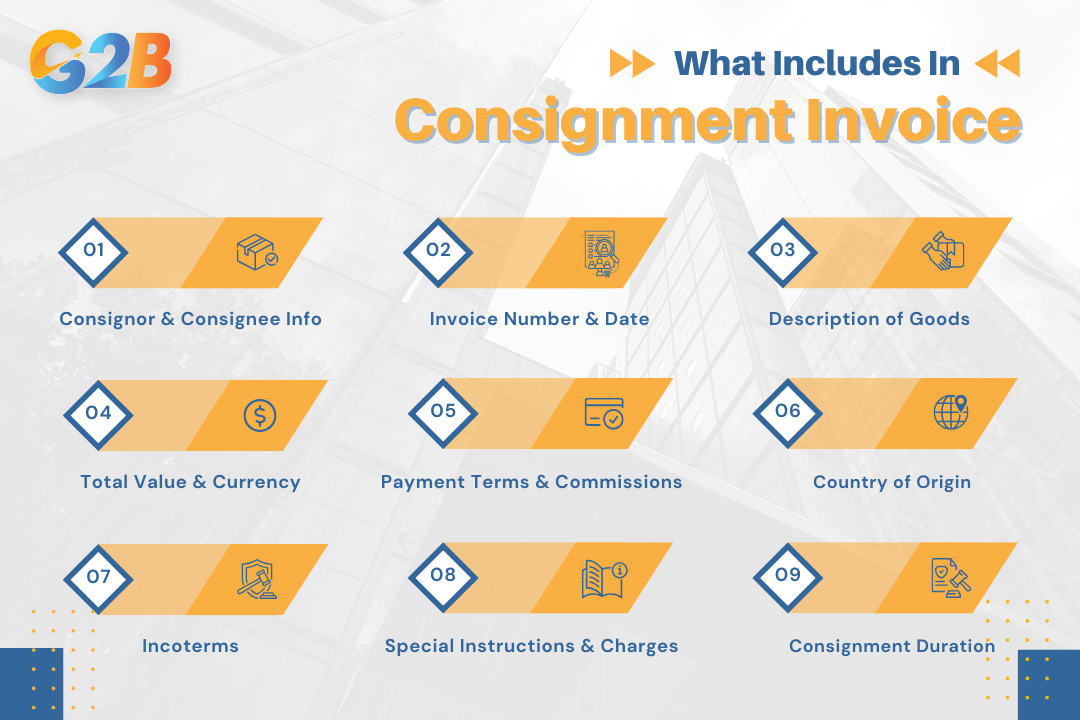

A standard consignment invoice contains comprehensive information essential for proper transaction management:

- Shipper (consignor) and consignee details include complete names, addresses, and contact information of both parties involved in the consignment arrangement. This information ensures proper identification and facilitates communication throughout the consignment period.

- Invoice number and date provide unique identification for tracking and reference purposes, enabling easy retrieval of transaction records and maintaining chronological order in accounting systems.

- Description of goods encompasses detailed information about the type, quantities, and unit prices of consigned items. This section should include product specifications, model numbers, and any relevant characteristics that distinguish the goods from similar items.

- The total value and currency of the transaction specify the estimated or invoiced worth of consigned goods and the monetary unit used for valuation. This information is crucial for insurance purposes, customs declarations, and financial reporting.

- Payment terms, due dates, and commission structures outline the financial arrangements between consignor and consignee, including when payments are due, commission rates, and any special conditions affecting remittance of sale proceeds.

- Country of origin indicates where the goods were manufactured or produced, which is essential for customs clearance, trade regulations, and potential preferential tariff treatments under various trade agreements.

- Incoterms (international commerce terms) define the responsibilities and risks associated with transportation and delivery of goods, clarifying which party bears costs and risks at different stages of the shipment process.

- Special instructions or additional charges cover any specific handling requirements, shipping costs, insurance coverage, or other expenses that may apply to the consignment arrangement.

- The duration of the consignment agreement specifies the period during which the consignee has the right to sell the goods, after which unsold items may need to be returned or the agreement renewed.

A standard consignment invoice contains 9 components for proper transaction management

Consignment invoice in Vietnam

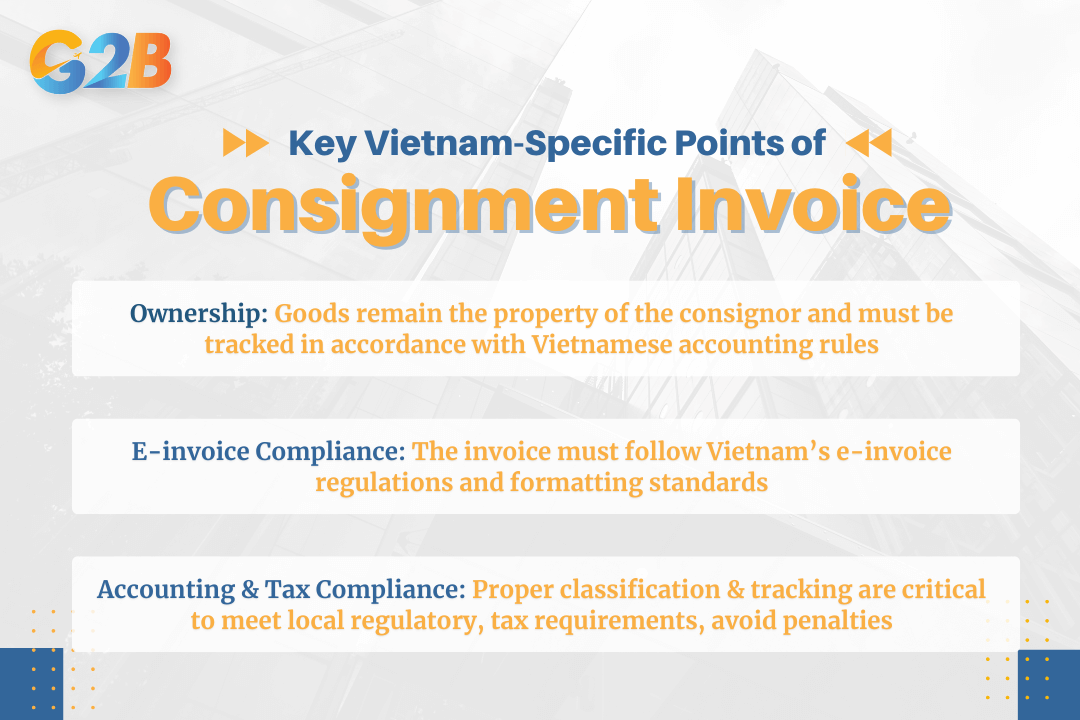

In Vietnam, consigned goods are managed under Account 157 - Goods sent on consignment, as prescribed by national accounting standards. The consignor retains ownership of the goods until they are sold by the consignee, and these retained goods are tracked in the company's accounting system, but not included in sales revenue until the time of sale. The costs associated with transportation or handling are recorded separately from this account to maintain accurate financial records.

A specific payment table (Form No. 01-BH under Circular 200/2014/TT-BTC) is used for consignment goods, wherein payment status and transactions are documented for accounting and settlement purposes. The form tracks the payment relationship between the consignor and consignee and serves as a basis for accounting entries and final settlement of consignment transactions.

Key Vietnam specific points:

- Goods on consignment remain the property of the consignor and are tracked using specialized accounts that comply with Vietnamese accounting standards and regulations.

- The consignment invoice (and accompanying forms) must include all standard information and comply with Vietnamese e-invoice regulations where applicable as implemented by the Vietnamese tax authorities.

- Accurate tracking and correct classification under local accounting standards are crucial for regulatory and tax compliance, ensuring businesses avoid penalties and maintain good standing with authorities.

There are several key specific points of a consignment invoice in Vietnam

Consignment invoices represent a fundamental component of successful consignment trading relationships, serving multiple purposes from legal documentation to financial record-keeping and regulatory compliance. Understanding the structure, content, and specific requirements in different jurisdictions, such as Vietnam, is essential for businesses engaged in consignment arrangements. Proper management of consignment invoices not only ensures smooth business operations but also protects the interests of all parties involved while maintaining compliance with local and international trade regulations.

Delaware (USA)

Delaware (USA)  Vietnam

Vietnam  Singapore

Singapore  Hong Kong

Hong Kong  United Kingdom

United Kingdom